Investors experience market swings as a normal part of investing, and this year has been no exception. While market declines – such as the tariff-driven sell-off – can be uncomfortable, they also create opportunities to invest at more attractive valuations. On the other hand, when markets recover and climb to record levels, some investors may feel uneasy even if the underlying fundamentals are still strong. In both scenarios, holding portfolios that can weather all phases of the market cycle, with an eye toward long-term financial goals, becomes even more important.

As we begin the final quarter of the year, investors are facing conflicting signals. The S&P 500 reached new all-time highs in the third quarter as markets continued to be supported by strong corporate earnings and enthusiasm for artificial intelligence. At the same time, the labor market has weakened considerably since the beginning of the summer, raising concerns over the underlying economy and the financial health of consumers. Despite this, GDP growth has been strong, and inflation has largely stayed in check.

Market environments like these are when the benefits of long-term investment and financial plans shine. Rather than reacting to headlines and economic reports, it’s more important to hold well-constructed portfolios that can withstand market shifts. This requires understanding the underlying trends that will shape markets in the quarters ahead.

Key Market and Economic Drivers in Q3

- The S&P 500, Nasdaq, and Dow Jones Industrial Average gained 7.8%, 11.2%, and 5.2%, respectively, during the third quarter, with all three reaching new record highs in September. Year-to-date, they have risen 13.7%, 17.3%, and 9.1%.

- The Bloomberg U.S. Aggregate Bond Index gained 2.0% in the third quarter and is now up 6.1% year-to-date. The 10-year Treasury yield ended the quarter at 4.15% after falling as low as 4.02% in September.

- Developed market international stocks (MSCI EAFE) rose 4.2% and emerging market stocks (MSCI EM) increased 10.1% in the quarter.

- Gold rallied to a new record level of $3,841 per ounce, representing a 16% gain during the quarter.

- Bitcoin ended at $114,641 for a gain on the quarter, although it is still below its August peak.

- The U.S. Dollar Index fell to a low of 96.63 in September before ending at 97.78 for the quarter. So far this year, the dollar has declined 9.9%.

- The Consumer Price Index increased 2.9% in August while core CPI rose 3.1%.

- Only 22,000 net new jobs were created in August according to the latest report by the Bureau of Labor Statistics. Since May, the average monthly pace of job gains has been only 26,800.

- At its September meeting, the Federal Reserve cut rates by 0.25% to a range of 4% to 4.25%.

Valuations continue to climb toward historic levels

|

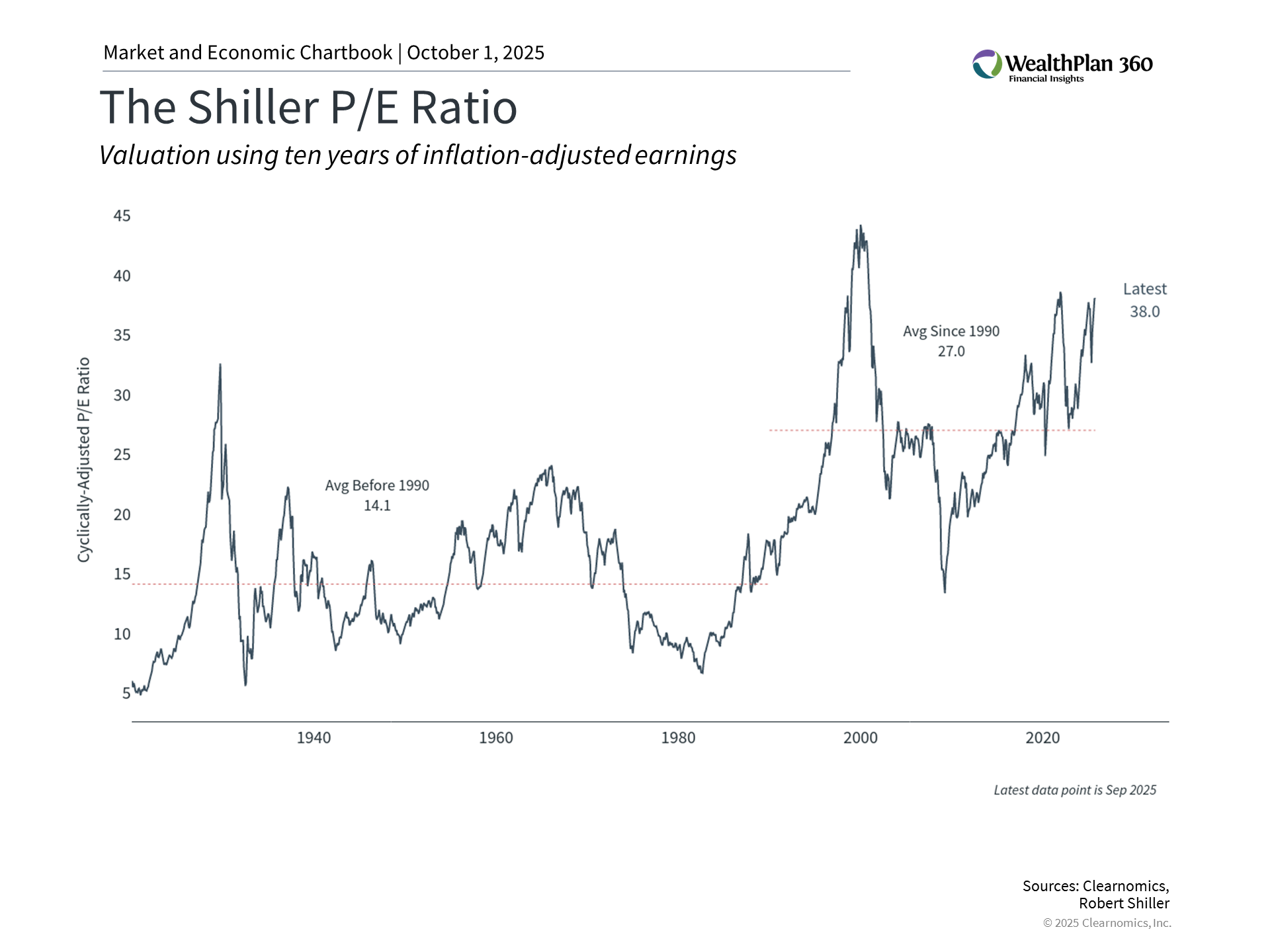

One of the most important considerations for long-term investors is the level of valuations for the overall market. Rather than simply focusing on the price of the market, valuations tell us what we’re getting for that price in terms of earnings, cash flow, sales, dividends, and other corporate fundamentals. While high valuations suggest that investors are optimistic, they also imply that expectations may be too lofty in some parts of the market.

The accompanying chart demonstrates this with the Shiller price-to-earnings ratio for the S&P 500. The current value of 38x is well above the 35-year average of 27x and is approaching levels last seen during the dot-com bubble. This measure provides a longer-term perspective than standard P/E ratios by using a ten-year history of earnings, adjusted for inflation.

The fact that valuations are at these levels should not be surprising given the strong rebound of the past two quarters. The S&P 500 has climbed 34% since April 8, resulting in a double-digit gain for the year. Technology stocks across various sectors have led the market on the way up, just as they led it on the way down. The Magnificent 7 stocks, for instance, have risen 61% since the bottom. While investors are increasingly questioning whether corporate spending on artificial intelligence will generate a positive return, the reality is that this has been a key driver of the broader market and business investment.

It’s important to note that valuations don’t predict short-term market movements and are not market timing tools. Instead, they serve as core inputs into the asset allocation process. While broad market valuations are elevated, this is not the case across all parts of the market. For example, small-caps, value stocks, and international stocks have more attractive valuations than large-caps, growth stocks, and U.S. stocks at the moment. This can create opportunities for investors with a broader perspective and longer time horizons.

The Fed is cutting rates amid job market weakness

|

The Federal Reserve cut interest rates by 0.25% in September 2025, resuming its easing cycle after holding rates steady through much of the year. This decision reflects the Fed’s attempt to balance stubborn inflation that remains above the 2% target with a weakening labor market. This rate cut was widely expected and has served as a tailwind for markets in recent months.

There are many factors that make this cutting cycle unique. Historically, the Fed has been forced to cut rates in response to economic crises or recessions. While there are some signs of weakness today, overall growth remains healthy. So, recent cuts represent something different: an attempt to normalize policy after the rapid tightening cycle that began in 2022. This is one reason the Fed is easing policy even while the economy remains in expansion and markets trade at all-time highs.

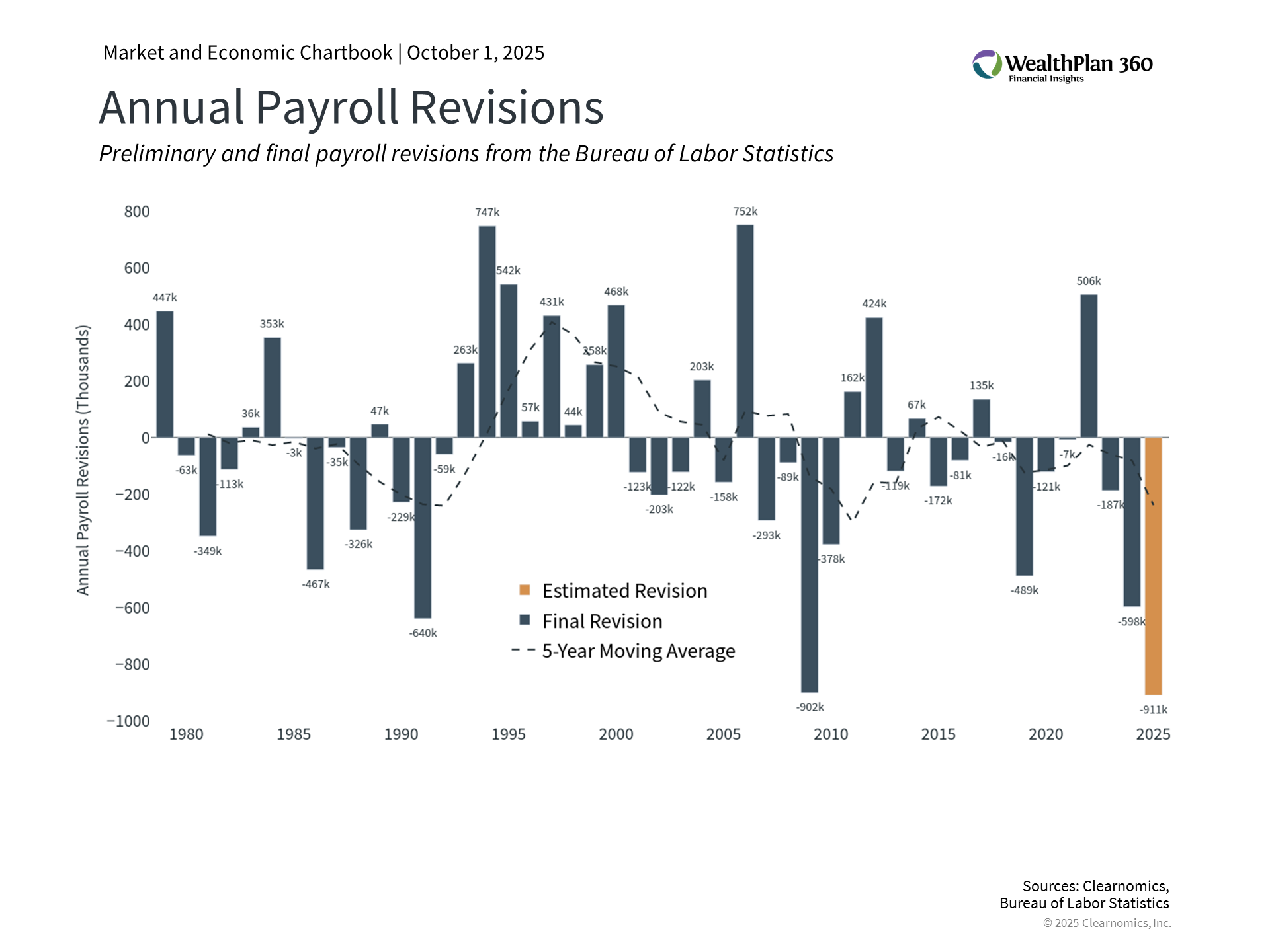

Perhaps the most important factor driving the Fed’s decision has been the deterioration in the job market. While the unemployment rate of 4.3% remains low by historical standards, the pace of job creation has slowed dramatically. August saw only 22,000 new payrolls added, well below the average of 123,000 from earlier in the year.

Even more striking are the payroll revisions suggesting that 911,000 fewer jobs were created over the twelve months through March than originally reported, as shown in the chart above. The Bureau of Labor Statistics revises the payroll numbers each year based on more accurate data than was available at the time of each monthly jobs report. While the numbers are still preliminary, a revision of this magnitude would represent the largest in history, showing that the job market has been weaker than originally believed.

Thus, the Fed is cutting rates because, according to the latest FOMC statement, it “judges that downside risks to employment have risen.” For investors, rate cuts typically provide support for both stocks and bonds if the economy remains strong.

Market volatility and policy uncertainty have eased for now

|

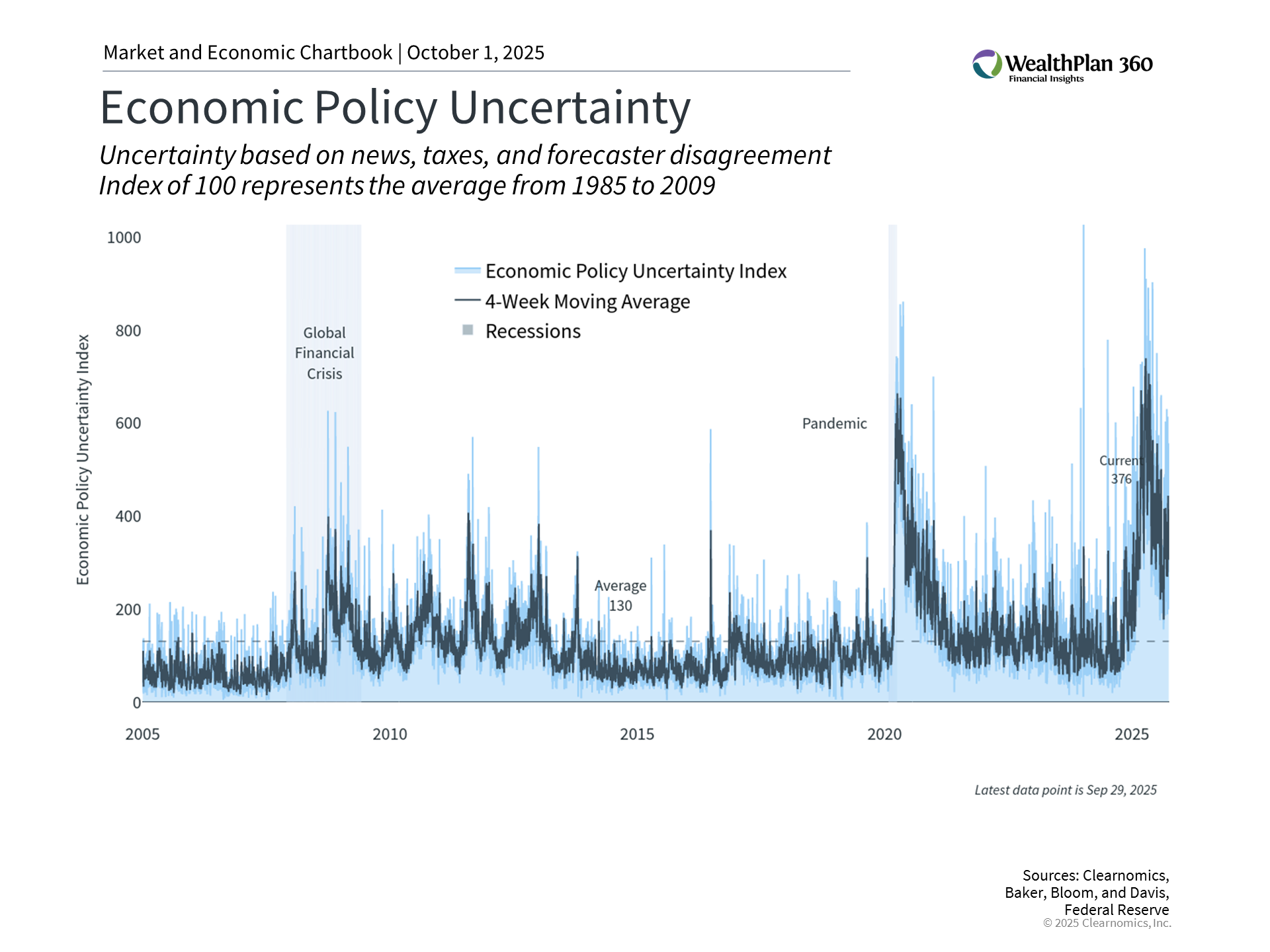

After significant volatility driven by tariffs and taxes earlier this year, measures of economic policy uncertainty have improved. The VIX index of stock market volatility is hovering around 16.3, below the long run average of 18, while the MOVE index of bond market volatility has declined to 78, below the average of 87.

As many long-term investors know, periods of market calm can change quickly. The last several years have experienced many episodes of heightened volatility due to inflation, trade wars, Washington policy, the Fed, recession fears, geopolitical conflicts, and more. The current government shutdown is but the latest event that could rattle markets in the short run, even if the long run effects are limited. Similarly, the outcome of tariff policies and the impact on inflation remain uncertain.

For investors, this uncertainty may feel uncomfortable, but it’s also what drives long-term portfolio outcomes. The last several years also highlight the difference between what investors feared and how markets actually performed. Rather than viewing uncertainty as something to avoid, successful long-term investors recognize it as a feature of markets that creates the opportunity to position portfolios for the years ahead.

The bottom line? As the final quarter of the year begins, markets are near all-time highs amid conflicting economic signals. This environment underscores the importance of maintaining an appropriate asset allocation and staying focused on financial goals.