Social Security, one of the most important government programs for retirees, has evolved over its 90-year history. As the aging population grows, so too do concerns about whether Americans will be able to rely on benefits in retirement. While Social Security is important, it is only one part of a well-crafted financial plan. In this economic and political environment, it’s important to understand all of the components of retirement planning to pursue long-term financial goals.

Whether you’re days or decades away from retirement, it’s never too early to understand how Social Security fits into your financial plan. To have perspective on the opportunities and risks, it’s important to understand the program’s history, current challenges, and the strategies available to navigate what’s ahead.

A brief history of Social Security

|

Established in 1935 during the Great Depression under President Franklin D. Roosevelt, Social Security was designed as a social safety net for older Americans. What began as a program paying modest benefits to a relatively small group has evolved into a complex system that supports millions of retirees, disabled workers, and their families. Today, Social Security benefits represent a significant portion of retirement income for millions of Americans.

So, what are the challenges facing Social Security today? The program operates primarily on a pay-as-you-go system. This means that the payroll taxes of current workers are used to pay for current benefits. In other words, the payroll taxes you paid do not go toward your own benefits in the future, but toward a current beneficiary’s Social Security checks.

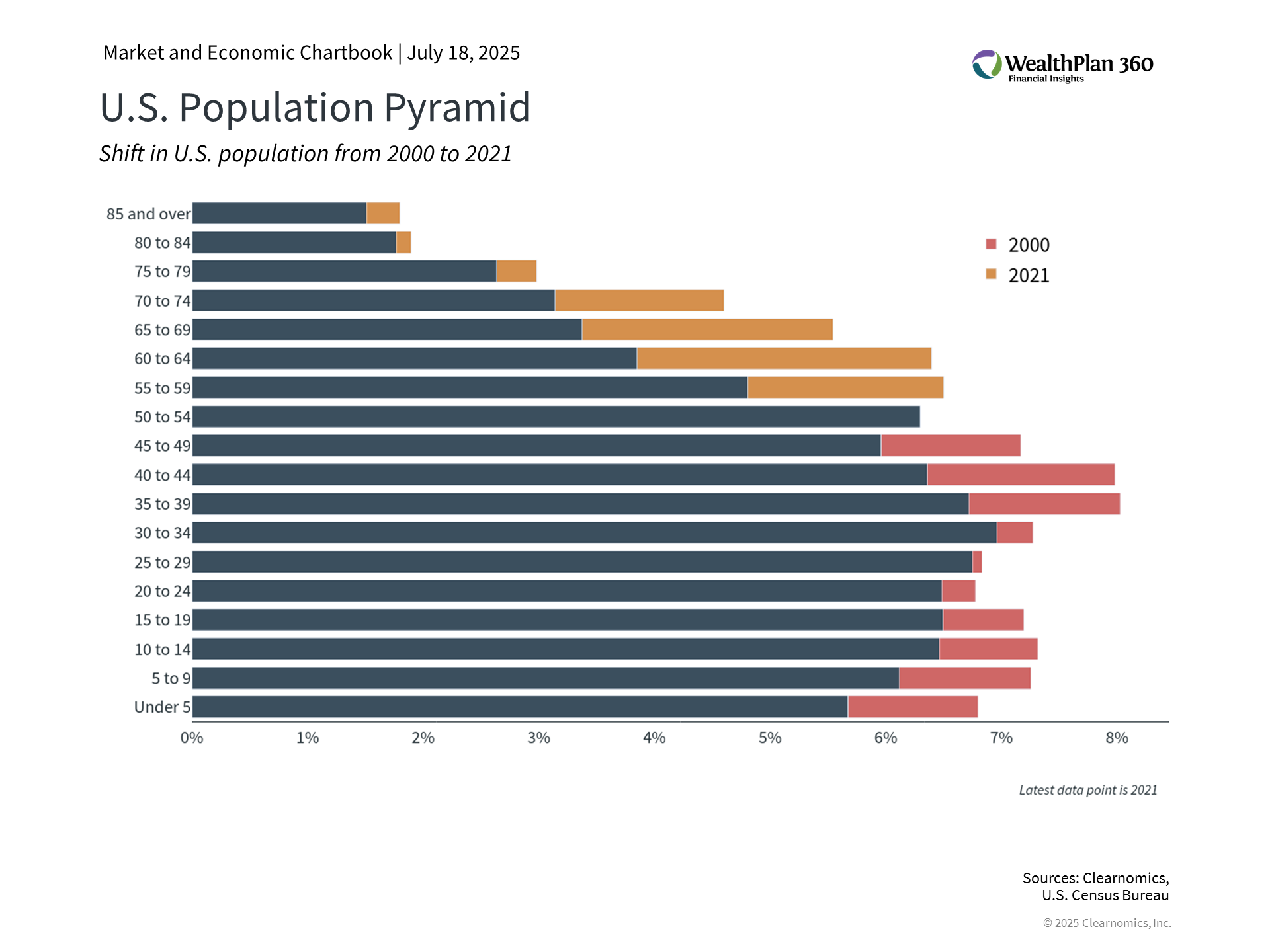

This system worked well when the ratio of workers to beneficiaries was high, as they were throughout much of the 20th century. However, demographic shifts have meant there are fewer workers to fund the program even as there are more retirees seeking benefits. Specifically, in 1940, there were 42 workers for each retiree. Today, that ratio has fallen to around 2.8 workers per beneficiary, and is projected to decline further as the population ages and the birth rate continues to trend downward.

There have been many projections on when the Social Security trust funds will be depleted. The latest projection from the Social Security Board of Trustees estimates that reserves are sufficient until 2034, after which benefits would need to be reduced. At the moment, ongoing payroll taxes would still cover about 78% of scheduled benefits. While the exact timeline may shift, the underlying challenge remains consistent: without reforms, the trust funds may not be able to pay full scheduled benefits indefinitely.

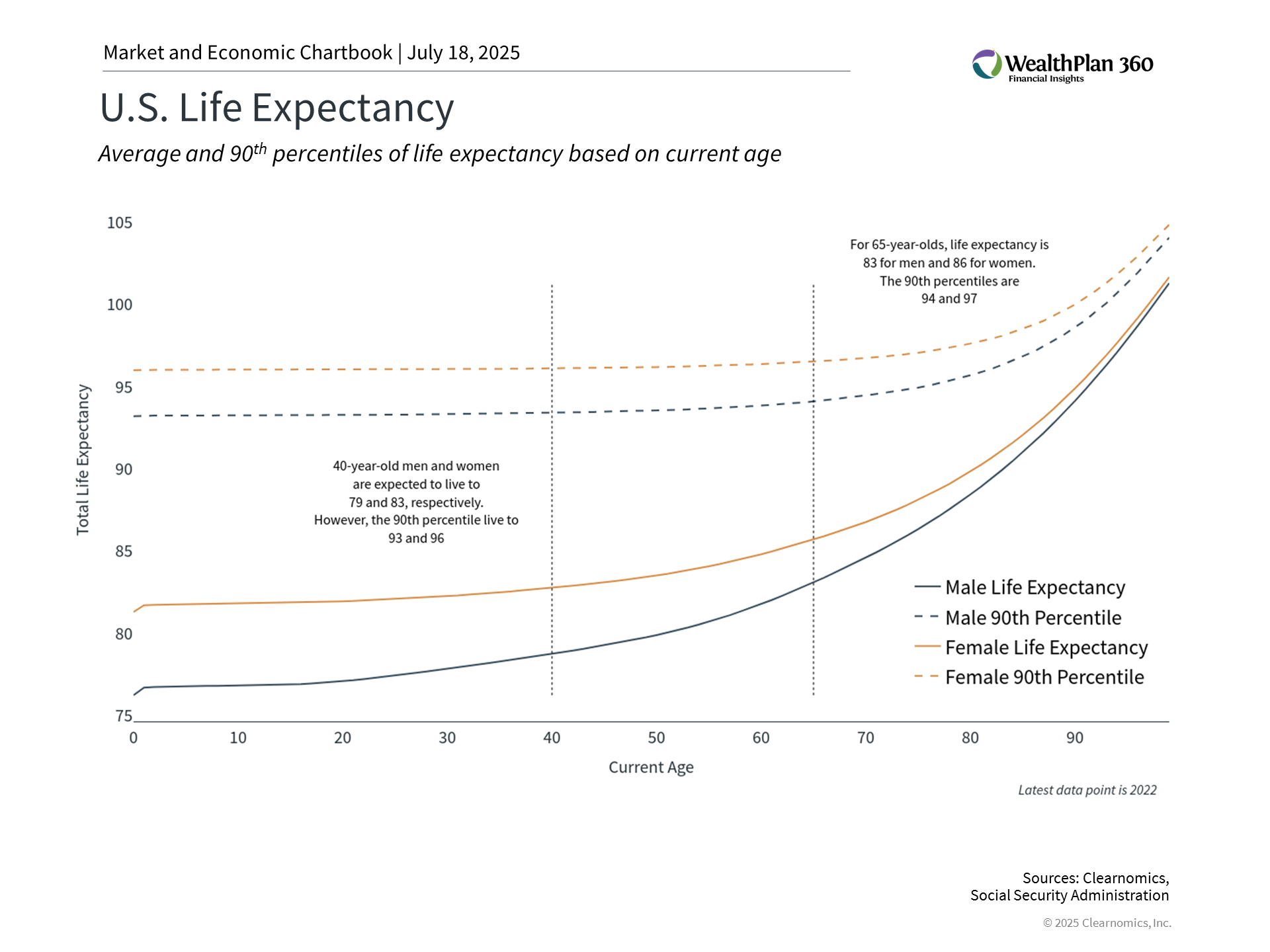

Living longer is a blessing, but a challenge for the Social Security trust fund

|

The national debt and deficit also raise concerns about the sustainability of the program, with the debt nearing $37 trillion and the country running persistent deficits. Even though Social Security is considered “mandatory,” the pressure to cut government spending creates uncertainty around how Congress may change these programs in the future.

It’s no surprise that potential solutions are subject to intense political debate, making a near-term fix to Social Security unlikely. Some proposed ideas include raising the retirement ages for starting benefits, increasing the taxable wage cap, and reducing fraud in the system. Unfortunately, there are few long-term strategies to fix Social Security once and for all.

It can help to look to other developed nations that have faced similar demographic challenges. For example, several European countries including France and the UK have increased retirement ages to reduce strain on their systems. Australia has taken a different approach, with a “means-tested” calculation that only provides benefits to retirees under certain asset and income thresholds.

While the 2034 depletion date is still years away, the need for solutions will only rise in urgency. Complete elimination of benefits is highly unlikely, though the ongoing funding challenges for Social Security will likely mean that modifications have to be made.

Strategic Considerations for Retirement Planning

Turning to individual actions, prudent planning is necessary to stay on track toward retirement given this uncertainty around Social Security. What decisions make sense depend on your holistic financial plan, goals, tax considerations, and more.

Here are some important factors to consider:

- Deciding to Delay

Retirement benefits can start as early as age 62, however, receiving benefits early reduces the monthly payment. Conversely, delaying benefits until age 70 can increase the monthly payment by approximately 8% per year beyond full retirement age (66-67, depending on birth year), according to the Social Security Administration. A breakeven analysis can help determine if delaying is a worthwhile strategy. Generally, if you live beyond your early 80s, delaying benefits results in higher lifetime payments. However, this analysis changes if you account for the time value of money or opportunity costs.

- Bridge Strategies

The value of delaying depends largely on what you do for income while waiting. Some retirees use portfolio withdrawals as a “bridge” to higher Social Security benefits later. This strategy can be particularly valuable for married couples, where maximizing the higher earner’s benefit creates a larger survivor benefit.

- Tax Implications

Up to 85% of Social Security benefits may be taxable, depending on your combined income. Future tax law changes could potentially increase this percentage. Strategic withdrawal planning with the help of a trusted advisor can help minimize the tax impact of your benefits.

- Conservative Assumptions

For those earlier in their careers, they have more time to prepare for retirement and more options to adjust for the uncertainty of Social Security. Thus, younger workers may consider building retirement plans that don’t rely heavily on Social Security. This doesn’t mean ignoring it entirely, but rather treating potential benefits as a supplement to personal savings rather than a foundation.

- Stay Informed of Policy Changes

Policy changes will likely occur before the trust fund depletion date. Staying informed about proposed reforms helps you adjust your planning accordingly. Possible changes include further increases to the full retirement age, adjustments to the benefit formula, or changes to payroll tax caps.

- Maximize Tax-Advantaged Accounts

With Social Security’s future uncertain, maximizing contributions to 401(k)s, IRAs, and HSAs becomes even more important. These accounts provide tax advantages that can help compensate for potentially reduced government benefits.

The Future of Social Security Requires Careful Planning

Despite legitimate concerns, it’s important to maintain perspective. Social Security has faced funding challenges before, and political pressure to preserve the program remains strong.

The prudent approach is neither blind faith nor complete dismissal of Social Security’s role in retirement planning. Instead, investors should recognize the program’s importance while treating it as only one component of a diversified retirement strategy.

The bottom line? By understanding Social Security’s challenges, you can build a more resilient retirement strategy regardless of your current age or career stage.